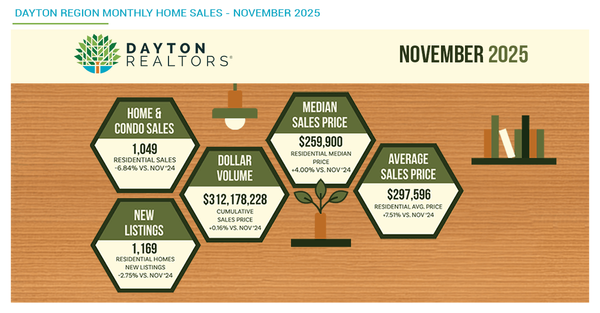

Beavercreek, OH Real Estate Market Update: What Local Sellers Need to Know This Spring

In Beavercreek, OH, it's time for a classic real estate market update on what local sellers need to know this spring! If you're thinking about putting your home on the market, understanding the current trends can help you make confident, informed decisions. Here’s a look at what local sellers need

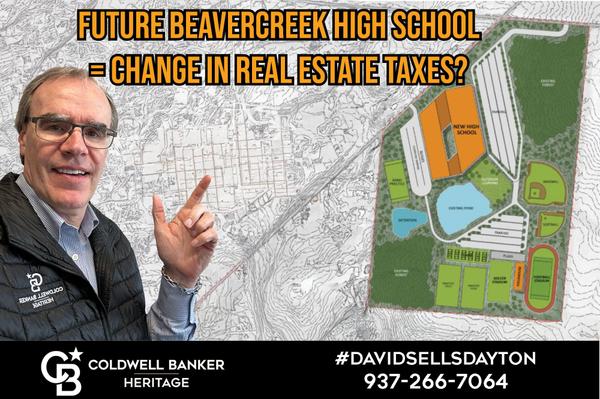

Future Beavercreek High School = Higher Real Estate Taxes?

Did you hear about the proposal for a new Beavercreek, OH High School and the higher real estate taxes it will cause? It will be up to voters to decide as it will be on the ballot this November. Beavercreek City Schools has proposed a $265 million bond issue to construct a new high school, aiming t

How to Pick the Best Local Realtor to Sell Your Home in Dayton, OH

Is Your Realtor Selling a Lot of Homes? Have you caught yourself wondering how to pick the best local realtor to sell your home in Dayton, OH? You want a Realtor that is active, in the game and knows how to get you to the closing table. But how do you know? Go to Zillow.com and search for their nam

Categories

Recent Posts