- Home

- Why David

- Happy Clients

- David's Realtor Tips

- Real Estate Videos

- Cities

- Buy or Sell

- Learn about Dayton's Cities

- Dayton-Ohio-The-Gem-City

- Miamisburg Ohio - Ohio's Star City

- Beavercreek Ohio - City of Commerce

- Kettering Ohio - City of Innovation

- Bellbrook, Ohio - Small Town Friendly

- Springboro Ohio - The Heart of Dayton

- Huber Heights - City of Growth

- Oakwood Ohio - The Wright City

- Xenia Ohio - City of Hospitality

- Centerville Ohio - Living History

- Fairborn, OH - A City in Motion

- West Carrollton - The River City

- Resources

-

- Register

- Sign In

REALTOR TIPS

ALL REALTOR TIPS

INCLUDE APPRAISAL GAP COVERAGE IN MY REAL ESTATE OFFER?

INCLUDE APPRAISAL GAP COVERAGE IN MY REAL ESTATE OFFER?

If you are trying to buy a house in the Dayton, Ohio area maybe you've heard the term Appraisal Guarantee or Appraisal Gap Coverage. I've been a Realtor for 30 years but I'd never heard of it until we hit a hot market in the Kettering, Beavercreek, Bellbrook and surrounding areas starting about 2019. In a strong Seller’s Market we often see multiple offers on a single property. Going over asking price has certainly been a popular tactic lately to try to win the property. Problem is it has become so basic it often takes more than that to prevail in a bidding war. Sometimes you need an even bigger advantage. One thing the seller gets worried about when the price goes over asking is if the property will appraise or not. If it does not appraise for at least the contract price then everything stops. Either the seller comes down to meet the appraised value, the buyer throws in some extra money or a combination of the two. So that large amount over asking that seemed so awesome at the time, doesn’t help a bit if the appraisal is short. Offering Appraisal Gap Coverage might be the answer to put the seller's mind at ease and help your offer get picked. This means that if the property does not appraise for the contract price the buyer agrees upfront to make up the difference or a certain amount of the difference with cash! The seller loves this because it insulates them from a low appraisal. Some buyers get nervous with this option feeling like they are paying more this way. Remember, the price is the same as you agreed to. You are just putting more money down. Not everyone that can do this is willing to do it. Just know it is an option and I can explain in more detail the ins and outs of it. Happy to share other best Realtor practices with you as well when it comes to making your offer stand out.

MORE

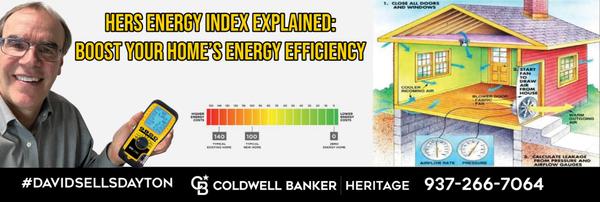

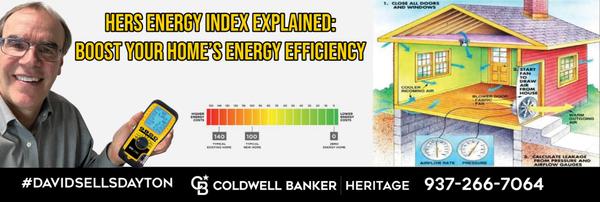

HERS Energy Index Explained: Boost Your Home's Energy Efficiency

HERS Energy Index Explained: Boost Your Home's Energy Efficiency

Dayton OH is not known for really extreme swings in temperature from season to season but it gets cold and hot enough here that an efficient house can save you significantly on energy bills. This is where a HERS test can provide valuable energy efficiency info. It stands for Home Energy Rating System and it is a nationally accepted standard used to measure the efficiency of a house. It is based upon a scale where a score of 100 is the baseline reference point of a home built to code in 2006. If you score a 90 then your home is 10% MORE efficient than the standard. If you score a 115 your home is 15 percent LESS efficient than the rating standard. You are using 15% more energy and some work could save a lot of money in the long run. A well built modern home is likely to have a HERS score in the 60s range. This home will feel more comfortable and consistent than the ‘standard’ home and the bonus is you’ll save money on utilities at the same time! Having a HERS test done involves two primary tests. One is a smoke test to see if the ductwork is leaking. A fog machine is often enlisted to provide visual results from this as well as taking airflow measurements. A blower door test is used to determine how much air infiltration the shell of the home may have. A lot of newer homes in the Dayton OH area tend to fall in the 65-85 range. When we sell a home in Dayton this is not a typical test to perform during inspections but you can do it anytime to see where your home measures up. A typical test may run between 400 and 1000 dollars.

MORE

Dayton Ohio Homes Stats Oct 24 vs Oct 23

Dayton Ohio Homes Stats Oct 24 vs Oct 23

How did real estate sales shape up in Dayton, Ohio in October? Single-family and condominium sales reported by Dayton REALTORS®’ Multiple Listing Service reached a sales volume of $347.7 million in October, an increase of 5% compared to the sales volume that occurred during the same month in 2023. Also increased in October were the average and median prices.The median price of $245,000 was 4% higher than last year and the average price of $278,667 posted an almost 5% gain over last October. The number of sales remained flat, with the 1,248 sales for the month besting October 2023’s number by 4 transactions. Year-to-date through October, there were 12,248 sales, up 6.8% compared to the same period in 2023 when 11,460 properties closed. The year-to-date average sale price and median sale price continued to rise as they have all year long. The average price totaled $278,447 – up over 9% – while the median price came in at $239,900, a gain of 6.6%. Single-family and condominium listing entries totaled 1,573 in October, down just 1% from October 2023. The overall MLS inventory at month’s end showed 2,169 active properties available for sale, which translated to a supply of 1.7 months based on October’s resale rate. The pace of sales was fairly even from last October, when a 1.8 month supply (2,241 listings) was available. If you’d like to see the stats for your home and neighborhood, just reach out!

MORE

REAL ESTATE DOCUMENTS AND CONTRACTS

Real Estate Title Insurance

Real Estate Title Insurance

Title insurance provides protection from defects in a real estate title. So, you are getting ready to close on a home and the title search you paid good money for shows the title is clean with no issues. Your lender is requiring that you also ( as part of your closing costs) pay for title insurance to cover them. Why? The title is clean? Is this just a money grab for the lender and title co? Title searches are not infallible and the lender knows it and won’t take the chance of not being covered. Even the best, most comprehensive title search in the world can’t uncover certain issues that can cause problems later. Suppose someone forged a document or deed on a prior sale. That could never be detected by a title search but if a lawsuit is filed because of it, you are left to cover the cost of defending your interest in the real estate on your own dime. You’ll have no luck recovering from the title company in this instance. Fraud, clerical errors, boundary disputes, undisclosed heirs and a number of other issues is where the right kind of title insurance can kick in to protect your interest. Title insurance that covers the lender is aptly named Lender’s Title Insurance. This does not cover the buyer. There is Owner’s Title Insurance for that. It’s an extra charge but at a reduced rate if you are already buying Lender’s Title Insurance. Title companies here in the Dayton, Ohio area will allow you to consider Owner’s Title up to 30 days after closing at the reduced rate. After that, a new title search will have to be done as well. The cost of this insurance is state mandated so the price is the same everywhere. The fee varies depending on the price of the home and loan amount, there are multiple online calculators to plug and chug if you want to know the cost. Feel free to reach out with any and all real estate related questions that come to mind!

MORE

Home Seller Closing Costs

Home Seller Closing Costs

As a home seller you want to know the total closing costs to sell your home, not just the commission. There are multiple players in a home sale and they each get paid for their service. Your agent can prepare a net sheet for you ahead of time based upon a suspected sale price. Costs and customs vary from area to area but here in Dayton Ohio it will look something like this:Marketing fee 6% of sale price – 3% to listing side and 3% to buyer side.Deed – 175.00, to the title co. to create a new deed.Conveyance fee – seller to pay X dollars per 1000.00 of sale price. We average 3.00 per 1000.00Disbursement fee – 175.00 to the title co.Owner’s Title insurance – Amount depends upon what was or was not agreed to in the contractHome Warranty – If agreed to in the contract seller may owe 500.00 -750.00 for a warrantyOvernight payoff – 30.00 to get your mortgage payoff quickly to your lender after closePest inspection – If a VA offer seller typically pays about 70.00 for the inspectionHOA assessment letter – If in an HOA could cost up to 300.00HOA transfer fee – Some HOAs charge to transfer to the buyer and seller pays approx. 100.00Tax proration – To the date of closing – cost based on tax bill and proration method agreed toMortgage payoff – what you owe on your current mortgageCertainly, each deal is different and your home could be subject to additional expenses if you live in an area requiring an occupancy permit, if your agent charges a transaction fee, if you have a second mortgage, if you agreed to pay part or all of the buyer’s closing costs, etc. If you are looking for a top Realtor in the Kettering, Bellbrook, Beavercreek and surrounding Dayton area please reach out and I’ll help you figure the closing costs on your home.

MORE

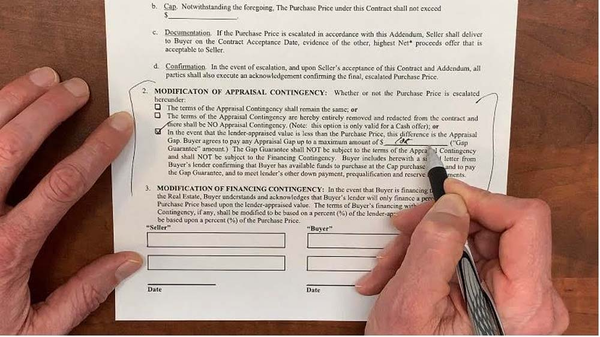

What is Appraisal Gap Coverage a.k.a Gap Guarantee?

What is Appraisal Gap Coverage a.k.a Gap Guarantee?

It goes without saying any seller wants the best offer on their home. Part of being the best is often the least risky offer. In our current escalating market sometimes the appraisers but the brakes on offers they feel are not justified. We call it a ‘short’ appraisal when the appraiser assigns a value less than the agreed upon sale price. his difference is called the appraisal gap. Sometimes it’s a couple thousand dollars and sometimes much more. In order to lessen the risk to the seller you can offer to guarantee any potential appraisal gap. Maybe you don’t want to be that exposed so you can offer a gap guarantee with a cap. Maybe 5k or 25k whatever you are comfortable with. Of course, this is in addition to your down payment and closing costs and you may be asked to provide proof of funds to do this. Offering this upfront to a seller can go a long way toward making your offer stand out because it reduces or eliminates the appraisal contingency for the seller.If you are looking for a top Realtor in Kettering, Bellbrook, Beavercreek, Dayton and surrounding areas please reach out.

MORE

ASK A REALTOR

HERS Energy Index Explained: Boost Your Home's Energy Efficiency

HERS Energy Index Explained: Boost Your Home's Energy Efficiency

Dayton OH is not known for really extreme swings in temperature from season to season but it gets cold and hot enough here that an efficient house can save you significantly on energy bills. This is where a HERS test can provide valuable energy efficiency info. It stands for Home Energy Rating System and it is a nationally accepted standard used to measure the efficiency of a house. It is based upon a scale where a score of 100 is the baseline reference point of a home built to code in 2006. If you score a 90 then your home is 10% MORE efficient than the standard. If you score a 115 your home is 15 percent LESS efficient than the rating standard. You are using 15% more energy and some work could save a lot of money in the long run. A well built modern home is likely to have a HERS score in the 60s range. This home will feel more comfortable and consistent than the ‘standard’ home and the bonus is you’ll save money on utilities at the same time! Having a HERS test done involves two primary tests. One is a smoke test to see if the ductwork is leaking. A fog machine is often enlisted to provide visual results from this as well as taking airflow measurements. A blower door test is used to determine how much air infiltration the shell of the home may have. A lot of newer homes in the Dayton OH area tend to fall in the 65-85 range. When we sell a home in Dayton this is not a typical test to perform during inspections but you can do it anytime to see where your home measures up. A typical test may run between 400 and 1000 dollars.

MORE

Slab Jacking: The Quickest Way to Correct Uneven Concrete

Slab Jacking: The Quickest Way to Correct Uneven Concrete

Do you have a sidewalk, patio or driveway that has settled or tilted and no longer even? Before you have it torn out and repoured, consider a solution that is less than half the cost. Slabjacking or lifting the concrete panel back into its original position is the quickest, cheapest, least messy way to handle it. The fix: One or more holes are drilled into the concrete. A grout-like material is pumped in the hole forcing the pad to ‘float’. Once the original position is reached the hole/holes are filled with a concrete mix and the grout will dry and it’s done! It’s that quick and simple. I’ve had many home sales ‘saved’ with this method. Feel free to reach out if you need further explanation or a referral for a contractor of this kind of work. It’s important to know why your patio settled? I commonly see this when showing and selling homes in the Dayton, Ohio area. It’s typically one of two things: The soil underneath was not properly compacted during construction. It’s really difficult to get the excavated soil around a construction site packed back down to the density it was before it was disturbed. Over multiple rains and freeze/thaw cycles it compacts tight again and shrinks taking the concrete slab with it. This kind of settling might start to show up at about the 5 yr mark after construction. Improper drainage or ponding around a concrete pad will compact the soil as well.

MORE

NAR Settlement - Home Buyer Change Explained

NAR Settlement - Home Buyer Change Explained

The National Association of Realtors Settlement has created a change on the buyer side of things. This change is nationwide, not brokerage or state specific. Now, all buyers who would like to tour a home with their broker must sign a buyer representation agreement with their agent PRIOR to being able to see the property. In the past, a buyer could contact a Realtor and request a showing without signing this. These buyer agreements are not new. A lot of agents have used them for years. Now, however, they are mandatory with everyone. Going forward, the new license law requirement is that a buyer agreement must be signed PRIOR to any showing taking place. The agreement clearly outlines the compensation paid to your agent. Typically, the seller will offer payment to the buyer’s agent just like in the past so that it is easier for the buyer to buy. However, if a seller is only offering partial or no compensation, the buyer will be responsible for the remainder. The changes on the buyer and seller side of things may leave you with questions on how they will work in practice. I work everyday in the Dayton housing market and would be happy to discuss how it all works.

MORE

INSPECTIONS

Sewer Line Backflow Peventer

Sewer Line Backflow Peventer

What is a backflow preventer? As a Realtor helping people buy and sell homes in the Dayton area, I’ve seen my fair share of unexpected surprises in homes, and one issue that often takes homeowners off guard is sewer backflow. This is when the sewer system reverses flow and comes back into the plumbing of the home. There’s a device that can stop this, and it’s not very expensive. $25.00 to $50.00. It’s called a backflow preventer. What types are there? There are 2 basic types. A gate valve and a float. They both are simplistic devices. The gate valve is nothing more than a one way flapper door. The door lets water flow out, but shuts when water tries to reverse flow like what happens when the sewer backs up. The gate style is for new construction to be installed in the floor prior to pouring the concrete. Float style uses a ball that allows water to pass as it goes down the drain and in the event of a backup at the street, the ball ‘floats’ upward and blocks the flow of water from making it to the interior of the home. This one is easier to install in an existing home. Remove your current floor drain cover and fit it inside the drain. Do all homes have them? Older homes generally won’t have these devices but they are great insurance. If you are in a new or newer home you may have noticed what looks like a 4 inch plastic disk on the floor, flush with the concrete floor. Hmmm, wonder what that is? That’s the maintenance cover to the valve so you check and maintain it. Whether you’re buying a new home or safeguarding your current one, understanding how a sewer backflow preventer works could save you from one of the messiest (and most expensive) plumbing problems you’ll ever face.

MORE

Damaged Sewer Pipe? Reline It!

Damaged Sewer Pipe? Reline It!

Maybe you’ve heard of repairing a sewer line with a ‘sewer sleeve’ or a ‘sewer liner’ or ‘trenchless line repair’. They refer to the same thing. Let’s say your Realtor recommended a sewer scope inspection for an older home you wrote an offer on. The inspection showed a broken clay tile. The traditional fix is to bring in a backhoe, dig a massive hole in the yard to replace the tile. There is an easier way. Think of the sleeve as a kind of long firehose being pulled through the line. It’s made of a felt-like material infused with resin. Once it’s in the line, air pressure is used to blow it up like a balloon tight against the walls of the sewer pipe. The resin dries to be rock hard and now the pipe is relined without digging! It’s very thin so the diameter of the pipe is not compromised. It’s seamless and smooth so it will actually flow better than the original. The entire sewer line can be relined or spot repairs are possible. They last from 20 to 50 years. The system seals out roots that so commonly penetrate between the clay liners. It also repairs leaks that can ultimately eat away at the supporting ground and cause a ‘belly’ in the line that results in sewer backups. As a local Dayton area Realtor I’ve run across many issues like this in older homes and this can be the less expensive fix in many cases. Reach out if I can be of assistance.

MORE

Wall Leaning? Wall Anchor the Answer?

Wall Leaning? Wall Anchor the Answer?

Is your basement wall bowing over 2 inches? Wall anchors may be the answer. Wall anchors are simple in design with just 3 main parts - 2 steel plates connected by one metal shaft. One plate is buried in the yard and the other plate sits against the bowing wall. The metal shaft connects the two plates and the shaft is tightened to apply force to the wall. The installer knows the proper torque to apply to the shaft to hold the wall in tension against movement. The outside plate is generally about 10 feet out in the yard. The plates (anchors) are placed about 5 feet apart. If you have a wall that is 24 feet long you’ll need 4 anchors. They cost about 1000.00 each. They are not designed specifically to straighten a wall, although they may help, but more to stabilize the wall to keep it from moving further. So, if you’ve made an offer on your dream home only to find a leaning wall during your inspection, don’t lose hope. Wall anchors may be just the ticket to repair. I see wall anchor systems in the Dayton, Ohio area from time to time when showing homes and know that they can work when installed as designed. If you have further questions about structural options please reach out - I have a variety of resources to pull from.

MORE

NEW CONSTRUCTION

What is the Difference Between a Truss and a Rafter?

What is the Difference Between a Truss and a Rafter?

Hello, I am David Campbell. Welcome to the Difference with David video series where I answer commonly asked questions about Real Estate. I'm on location at a new build site and wanted to answer a few questions I have heard about construction. Do you know the difference between a rafter and a truss? Watch more to learn these differences and why this is important during construction. More New Construction Videos

MOREWhat are Concrete Shrinkage Cracks in my New Home?

What are Concrete Shrinkage Cracks in my New Home?

Something that often comes up on new homes and old alike are cracks in the concrete slab. You can have a structural crack from shifting and movement but that’s not common. Those cracks are typically ‘off-set’ and can be large (wider than ¼ of an inch) What is common are shrinkage cracks. These range from a just barely noticeable hairline crack to an obvious crack like you see here. You’ll get these in most all large sections of concrete. Take a look at your driveway and sidewalk. Odds are you’ll find cracks. When concrete is poured it has a very high water content. As it cures this water evaporates and the concrete slab becomes smaller as it dries out. One thing we know for sure is concrete is not flexible so it won’t stretch back out and you end up with a crack. The concrete finishers will form ‘control joints’ in the concrete before it sets up and the idea here is to ‘control’ where the concrete cracks. Since you can’t stop it from cracking you might as well try to control where it does crack so the joints provide a weak line in the concrete that hopefully the crack will follow. If you are looking for a top Realtor in Kettering, Bellbrook, Beavercreek, Dayton and surrounding areas please reach out. More New Construction Videos

MORE

Water Heater Expansion Tank

Water Heater Expansion Tank

During showings I’m often asked, ‘What is this “thing” attached to the water heater?’ This ‘thing’ is known as an expansion tank. It helps to reduce the pressure on your water supply lines. If the pressure gets too great it can cause water to seep past the many valves in your plumbing system. There are the obvious valves at the kitchen and bathroom sinks but don’t forget, you have other valves such as those in your washing machine, outside spigots, toilet tanks, utility tubs, water heater pressure relief valves, etc. Aside from the valves there’s no need to subject the pipe and all the fittings to extra pressure. When water gets hot it naturally expands. This is where the added pressure comes from. The expansion tank has a bladder in it that will expand and make room for the greater volume of the hot water. Think of it as a balloon taking up about half of the space inside the tank. I’m always available to help with real estate questions that come to mind! More Home Inspection Videos

MORE