How to Pick the Best Local Realtor to Sell Your Home in Dayton, OH

Is Your Realtor Selling a Lot of Homes? You want a Realtor that is active, in the game and knows how to get you to the closing table. But how do you know? Go to Zillow.com and search for their name. Zillow will show you the number of homes they have sold in the last year. A single Realtor (not p

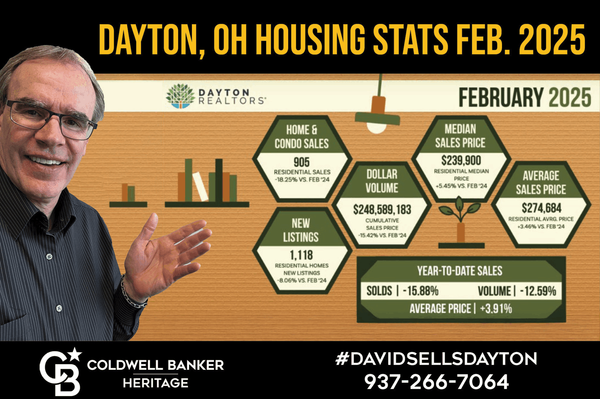

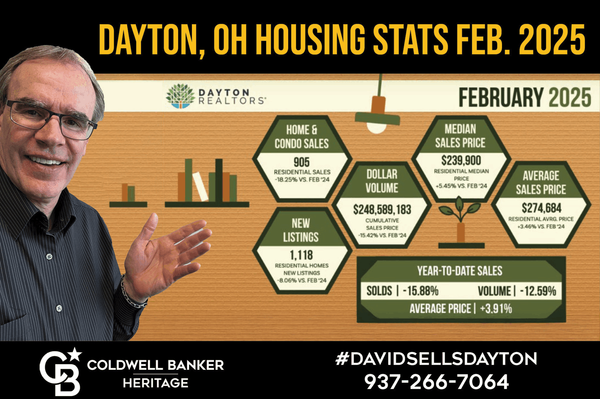

Dayton, Ohio Housing Stats Feb. 2025

Housing Stats Compared The news is full of national housing statistics. If you are looking to buy or sell a home in Dayton OH then you are most concerned with Dayton’s real estate market. Numbers don’t mean much until you compare. Let’s look at Feb 2024 vs Feb 2025. Home sales down over 18%, a tre

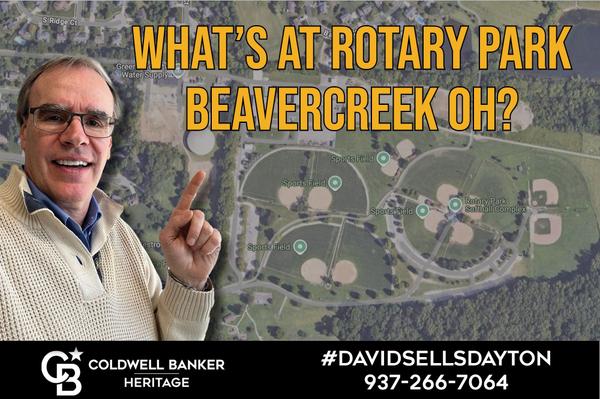

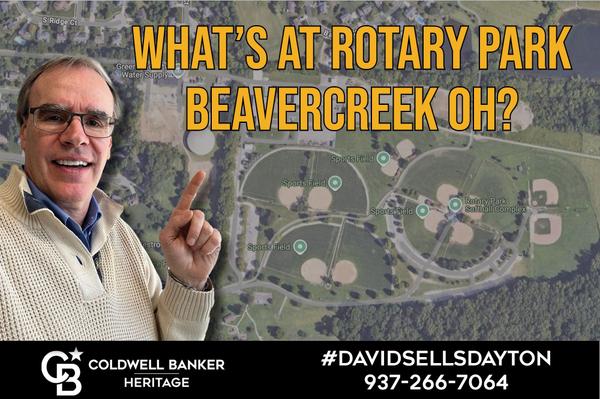

What’s at Rotary Park Beavercreek, OH?

How many parks does Beavercreek have? 10?, no there are more. 20?, no, there are more yet. 24! Can you believe it? As a local Beavercreek Realtor that has lived in Beavercreek pretty much my entire life, I didn’t realize we had 24 parks until I started researching for this blog post. Some of ou

Categories

Recent Posts