Real Estate Home Warranties Explained

You can think of a home warranty as an insurance policy for the mechanical systems in your house like HVAC, plumbing, electrical, appliances, etc. Not to be confused with homeowner’s insurance which covers your home against perils like fire, wind, falling trees, water etc. A home warranty lasts for 1 year with the option to renew. Most have a deductible for each system which usually runs from $50.00 to $100.00. It’s for EACH system so if you have a plumbing problem and electrical problem at the same time you’ll pay a deductible for each. There are usually several levels of coverage offered from just the main home systems with the basic coverage, to the top level handling coverage right down to door bells and garage door openers. There are add-ons too for pools, wells, septic. Coverage can be had for single family homes, condos, multifamily and mobile homes. We tend to think of warranties only on the ‘buy’ side but home sellers can benefit too. Many people are not aware that as a seller you can activate a warranty on your home while you have it listed! This can be a nice incentive for your buyer. Then transfer coverage to the buyer at closing. The best part is you are covered during the listing period and it may even help you with inspection issues. Over the years as a Realtor in the Dayton Ohio area I’ve seen home warranties save a lot of trouble. They are particularly important with aging higher cost systems like, furnace, A/C, water heater, plumbing. Most warranties run between $500 and $850 per year. A basic water heater replacement can easily run $1500 these days.

Appraisal Under Value, Now What?

When a real estate appraisal comes in under the agreed upon sale price we call it, a short appraisal. As in, ‘short’ of the value it needs to be. It can be a showstopper because the bank will only loan to that amount and the deal is in jeopardy. What now? There are 5 options with a short appraisal. The seller comes down to meet the appraised value The buyer brings extra money to closing to make up for the shortfall Buyer and Seller split the difference between the short appraisal Terminate the deal due based upon the financing contingency not being met Challenge the short appraisal and try to get it amended to meet the sale price None of these options are without pain. The seller never wants to come down, the buyer never wants to come up, no one wants to let the deal die and positive results from challenging a short appraisal are more scarce than hen’s teeth. In the end it often comes down to how badly each side wants to get to closing. I often see the parties split the appraisal gap. In my 30 year career selling real estate in Dayton, Ohio I’ve been through a lot of these and I know how to get you through these tough parts. Reach out if you need some assistance.

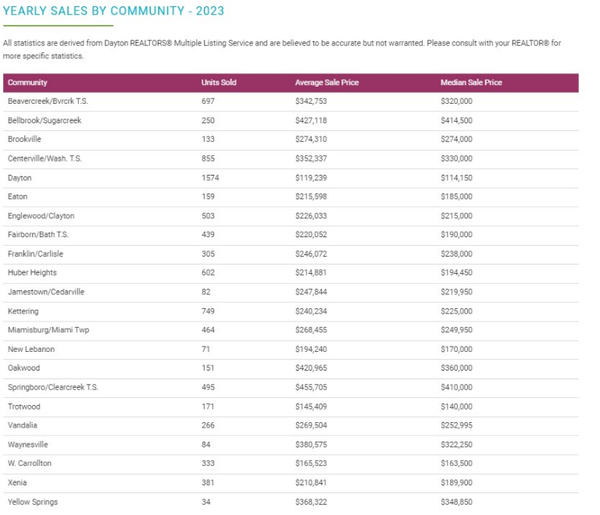

Realtor Tip: 2023 Year End Real Estate Sales

Ever wonder which communities in the Dayton area had the most sales? The highest average sale price? Well, you are in luck! The year-end sales stats for 2023 are in for the Dayton, Ohio area. When I’m working with out of town buyers in particular, they like to see how the communities stack up. Here’s a quick rundown on our popular cities. Feel free to reach out with any and all home buying or selling questions that come to mind after absorbing this fascinating data.

Categories

Recent Posts