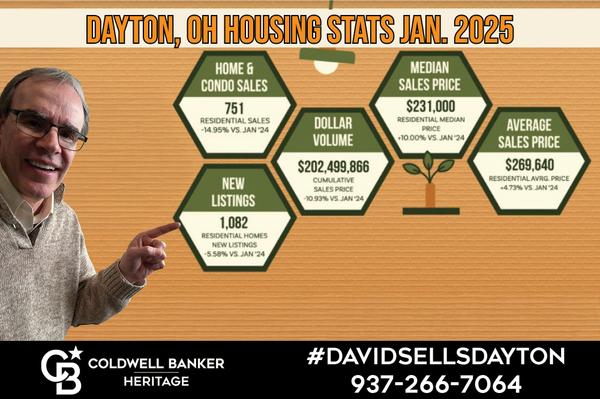

Dayton Real Estate Housing Stats Nov. 2024

As we Realtors always say, ‘All real estate is local’. So, if you live in the Dayton area - those are the stats that are important to you. The Dayton real estate market experienced a slight slowdown in November, according to data from Dayton REALTORS®’ Multiple Listing Service. Single-family homes

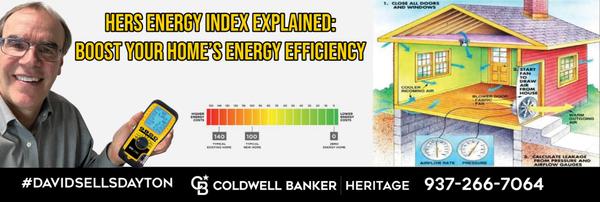

HERS Energy Index Explained: Boost Your Home's Energy Efficiency

Dayton OH is not known for really extreme swings in temperature from season to season but it gets cold and hot enough here that an efficient house can save you significantly on energy bills. This is where a HERS test can provide valuable energy efficiency info. It stands for Home Energy Rating Sys

Slab Jacking: The Quickest Way to Correct Uneven Concrete

Do you have a sidewalk, patio or driveway that has settled or tilted and no longer even? Before you have it torn out and repoured, consider a solution that is less than half the cost. Slabjacking or lifting the concrete panel back into its original position is the quickest, cheapest, least messy wa

Categories

Recent Posts