Real Estate Bridge Loan

Real Estate Bridge Loan

You may have heard it called a gap loan or a swing loan as well. It’s a short term loan you’ll typically pay off within a year. The bank will do an appraisal on your current home. You need plenty of equity in your home to make it work. At least 20% or the numbers just don’t make sense. The interest rate is higher but remember, they are interest only payments and you are not keeping the loan very long so the rate is much less of a consideration if it gets you the new house you want.

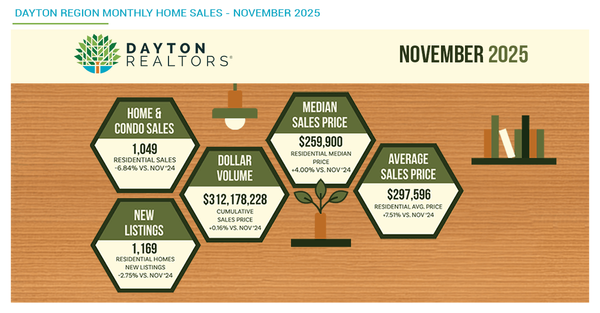

If you are in a market where your house may not sell fairly quickly or if there is something unique about your home that could result in a prolonged time on the market, a bridge loan may not be the best route. There are other options like a Blanket loan, a home equity loan, a home equity line of credit (HELOC) or cash-out refinance. I’ve worked the Dayton, Ohio area with various real estate loans for many years. Just reach out and I’ll help guide you to the best option for your situation.

Categories

Recent Posts

GET MORE INFORMATION