Do I Need to Pay Private Mortgage Insurance PMI?

Private mortgage insurance is a fee you pay to your lender if you are putting less than 20% down on your conventional mortgage. It insulates the lender from a loss if you default on your mortgage. If you are putting less than 20% down and having to pay PMI it’s important to know you are not stuck with it forever. Once you reach 78 percent loan-to-value the servicer of the loan must automatically termite the PMI. So, if you are ready to move but hesitant because you don’t have a full 20% down I wouldn’t let it stop me if I found a home I really loved. In time you’ll have the PMI dropped and you’ll be glad you moved forward on your dream home.

FHA has something similar call MIP or Mortgage Insurance Premium. Although VA loans don’t have mortgage insurance they do have something called a VA funding fee that helps them to cover losses and keep the program going. It’s a one time fee of approximately 2 to 3 percent and it can even be rolled into the loan for a true no money down VA loan.

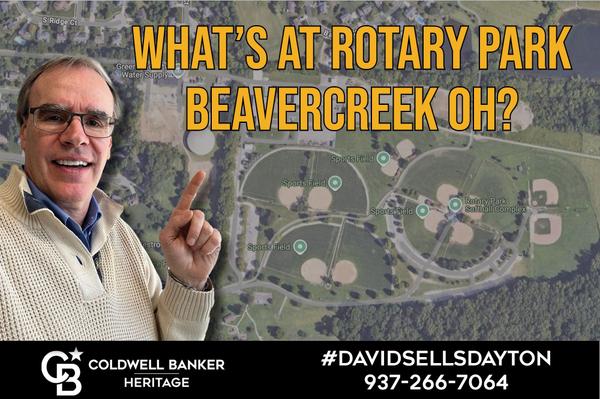

If you are looking for a top Realtor in Beavercreek, Bellbrook, Kettering and surrounding areas reach out to me and I’ll show you there is a Difference with David.

More Videos for Buyers

Categories

Recent Posts